OVERVIEW

Early wage access is a 21st century phenomenon. Allowing employees to receive a portion of their earned wages in advance, as opposed to receiving the entire amount on a designated payday, is changing payroll practice all over the country. What is payroll’s role in defining and creating best practice in this new area? What are the challenges of meeting a demand that mirrors our “instant gratification” society? Order an item online? Have it delivered by tomorrow. Order food from a local restaurant? It will be delivered within an hour. Want to be paid? That should be available on demand too, right? We’ll look at current practice as well as questions for the future of Early Wage Access/ Earned Wage Access and its usefulness in a time when wages and work are not as predictable as is the norm. The webinar will help attendees determine if the process is appropriate for their company and examine ways to determine their best path towards deployment.

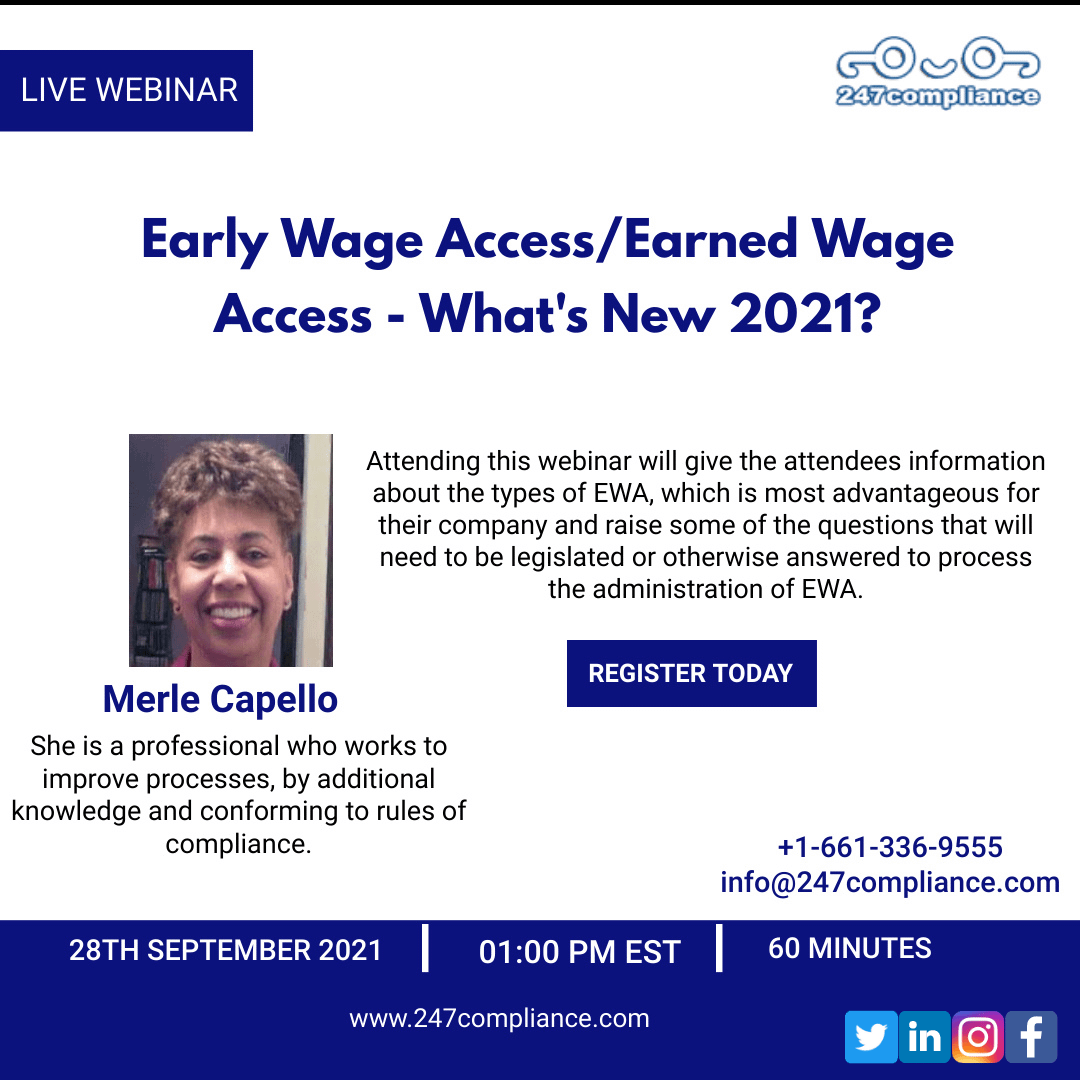

WHY SHOULD YOU ATTEND?

Early Wage Access/Earned Wage Access is becoming a progressively more important issue for many employers. Employees request that a portion of their pay be paid to them as soon as it is earned, as opposed to receiving 100% of their pay due on payday. During this time of pandemic business closings and modifications, employees may exhibit more anxiety about lowered or adjusted wages. Economic strain may force employees towards an EWA solution. Employers who are attuned to this trend should be ready to pivot towards making this adjustment. Attending this webinar will give the attendees information about the types of EWA, which is most advantageous for their company and raise some of the questions that will need to be legislated or otherwise answered to process the administration of EWA. Regardless of the size of your company, you’ll be able to learn something about this new trend by taking this webinar!

AREA COVERED

- Assessing the need for EWA-is it a fit for my company?

- How will it help or hurt my employer to offer EWA?

- Available methods of providing EWA

- Questions to be asked prior to deployment of an EWA program

- Looking at voluntary deductions-how are they handled?

- Legislative actions – Federal and State updates

- What is constructive receipt and how does it affect EWA?

LEARNING OBJECTIVES

- What does EWA mean?

- Is it feasible for you, or is it necessary?

- Why has EWA become so important? Has the pandemic made a difference in the interest in the service?

- How is it best deployed?

- What is the latest legal opinion on offering it?

- Should I use a vendor, or is that problematic?

- What types of parameters should my firm use to develop a policy on EWA?

WHO WILL BENEFIT?

- Payroll teams

- payment services teams

- shared service teams

- HR and Benefits teams