Please note that events are moderated so there may be a delay between you posting it and your event being live on the site.

- This event has passed.

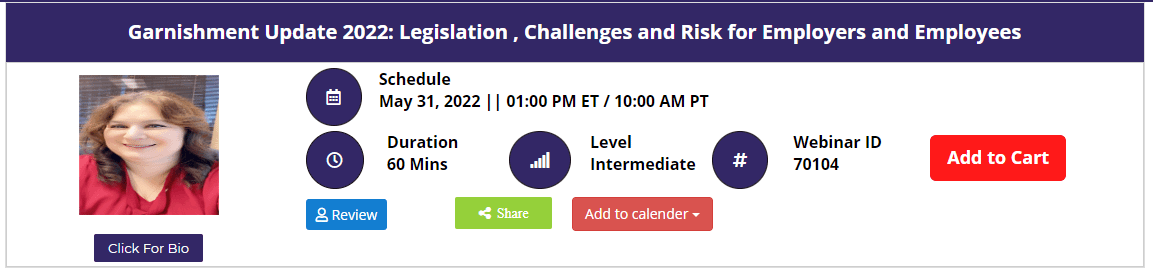

Garnishment Update 2022: Legislation , Challenges and Risk for Employers and Employees

31 May 2022 |1:00 pm - 1:30 pm BST

150

Garnishments are a requirement of doing business and having employees but juggling the requirements of different types of garnishments and federal and state laws can be exhausting. This webinar will give you the tips and tools to learn how to stay compliant and process garnishments Will talk about all the recent updates to Garnishment legislation due to the COVID-19 pandemic, including what garnishments should be stopped, what should continue, etc. Along with challenges and risks employers hold when not properly handling garnishments. Accordingly, we will review the impact of garnishments due to the recent tax reform.

This webinar with payroll expert Dayna J. Reum, CPP, FPC, will give you the tips and tools to learn how to stay compliant and process garnishments according to the law and in the business’s best interest.

This session will cover recent updates to garnishment legislation and challenges and risks employers face due to improper handling of garnishments. We will also review the impact of the current tax reform on garnishments.

Why Should You Attend

This session will cover recent updates to garnishment legislation and challenges and risks employers face due to improper handling of garnishments. We will also review the impact of the recent tax reform on garnishments.

Objectives of the Presentation

» Better understanding of employer responsibilities

» How to properly calculate garnishment deductions?

» Review of lump sum reporting requirements and how to comply

» Proper order of garnishment priority when an employer receives multiple orders

» How to determine which law to follow, state or federal?

Areas Covered in the Session

1. Child Support Review

» Employer Responsibility/Employee Protections

» Priority of Withholding/Multiple Orders

» Child Support withholding requirements

» Defining Income/Calculating disposable pay

» Lump Sum Payments

» Calculating Child Support Payments

» When to remit payments

» Administrative fees

» Handling terminated employees

» E-IWO (electronic income withholding orders)

» Other Child Support Concerns

» Medical Support Orders

» Details of State Requirements

2. Federal Tax Levies

» Forms

» Priorities

» Calculating deductions

» Special Situations

» Remittance Requirements

» Voluntary Deductions

3. Other Federal Garnishments

4. State Tax Levies

» Requirements

» State Laws

5. Creditor Garnishments

Who Will Benefit

» Payroll Professionals

» Accounting Professionals

» Tax Professionals

» Finance Professionals

» Compensation Professionals

» Benefits Professionals

» Senior HR Professionals

» HR Managers & Directors

» HR Personnel

» CEOs

» Managers

» Team Leaders

To Register (or) for more details please click on this below link:

<a href=”https://bit.ly/3lof3DT”>https://bit.ly/3lof3DT</a>

Email: support@concordeducations.com

Tel: (989)341-877300