Please note that events are moderated so there may be a delay between you posting it and your event being live on the site.

- This event has passed.

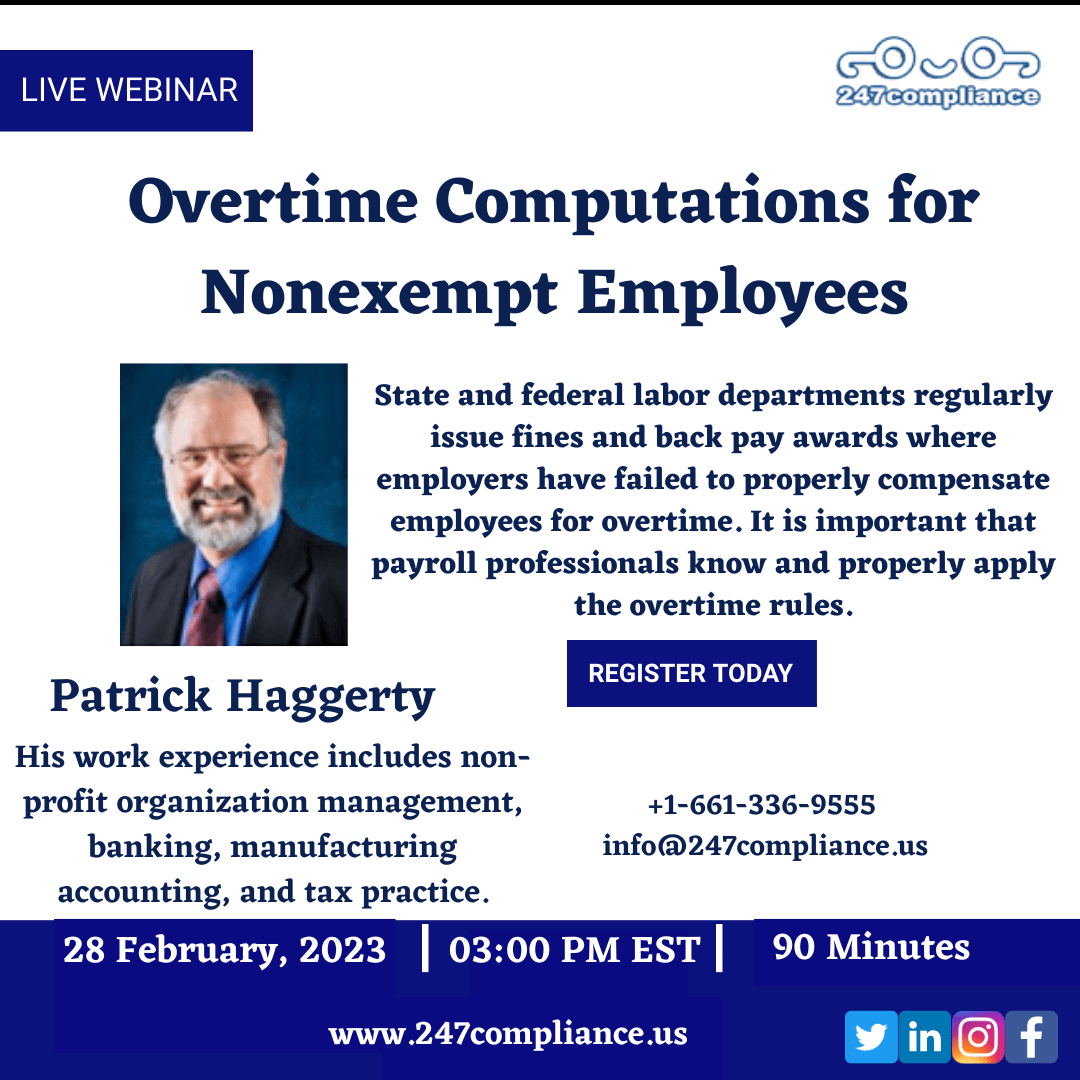

Overtime Computations for Nonexempt Employees

28 February 2023 |3:00 pm - 4:30 pm EST

199

Employers face unique challenges when calculating overtime for non-exempt employees, whether paid hourly, piece work, or salaried. Payroll professionals must consider commissions, bonuses, and other special wage payments, piece rates, shift differentials, multiple pay rates, and actual hours worked during a workweek when making their calculations.

WHY SHOULD YOU ATTEND?

Calculating overtime is not necessarily as simple as taking an employee’s hourly rate and multiplying it by 1.5. Issues include the determination of which employees are eligible for overtime, calculation of the regular rate of pay for overtime-eligible salaried employees, and properly taking into account bonuses, incentives,s, and shift-differential payments. There is a lot more to overtime calculation than initially meets the eye. Mistakes, even honest ones, can be costly. State and federal labor departments regularly issue fines and back pay awards where employers have failed to properly compensate employees for overtime. It is important that payroll professionals know and properly apply the overtime rules.

LEARNING OBJECTIVES

- Avoiding the pitfalls of artificial wage rates

- When bonus payments must be included in the regular rate of pay

- Computing the regular rate of pay for non-exempt salaried employees

- Allocating retroactive pay increases to affected pay periods

- Computing overtime rates when an employee has multiple regular pay rates

- Salary rates that include overtime pay

- The special challenge of semi-monthly pay periods

- Computing the overtime rate for piece-rate workers

WHO WILL BENEFIT?

- Payroll Supervisors and Personnel

- Payroll Consultants

- Payroll Service Providers

- Public Accountants and Enrolled Agents

- Internal Auditors

- Employee Benefits Administrators

- Officers and Managers with Payroll or wage and hour Compliance Oversight

- Company / Business Owners

- Managers/ Supervisors

- Public Agency Managers

- Audit and Compliance Personnel / Risk Managers