Please note that events are moderated so there may be a delay between you posting it and your event being live on the site.

- This event has passed.

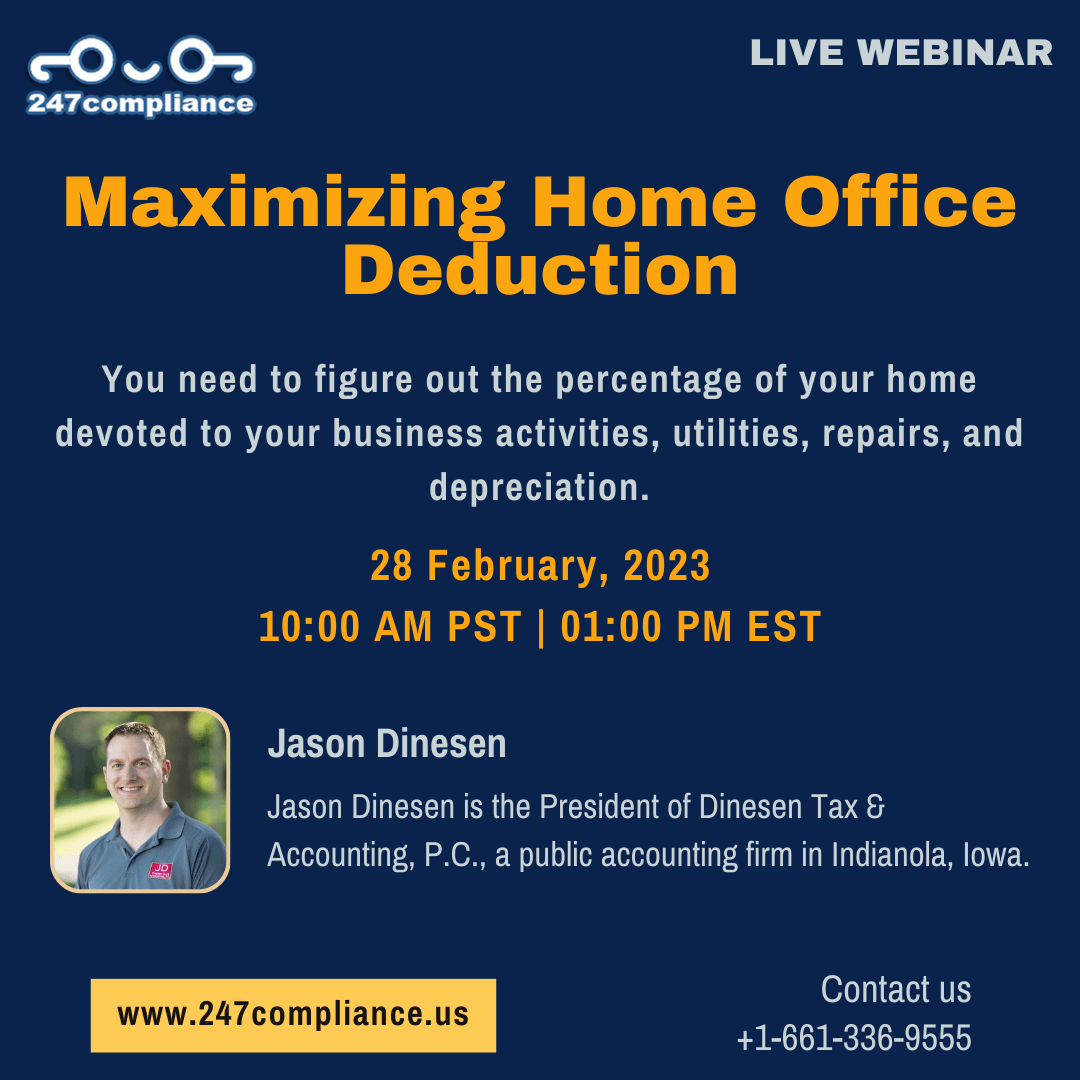

Maximizing Home Office Deduction

16 February 2023 |1:00 pm - 2:00 pm EST

199

Home office expenses might be one of the most feared business deductions due to concern over disallowance by the IRS. Thus, many taxpayers entitled to the deduction don’t claim it. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. You need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and depreciation.

WHY SHOULD YOU ATTEND?

- To recognize what the home office deduction is

- To identify ways how to qualify for a deduction

- To identify where and how to report

- To identify how daycares handle the deduction

AREA COVERED

- The tests for qualifying for a deduction

- Handling separate structures

- The two methods to calculate the deduction

- Special rules for daycares

- Dealing with sales of the office property, including using the Section 121 exclusion

- Business limits

- Red flags

WHO WILL BENEFIT?

- Office managers

- HR professionals

- Bookkeepers

- Accountants

- Business owners

- Financial planner

- Tax professionals