Please note that events are moderated so there may be a delay between you posting it and your event being live on the site.

- This event has passed.

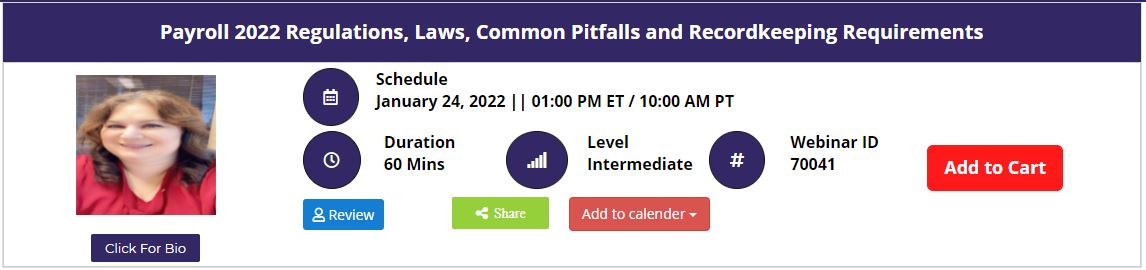

Payroll 2022 Regulations, Laws, Common Pitfalls and Recordkeeping Requirements

24 January 2022 |10:00 am - 11:00 am GMT

150

Due to the tax cuts and jobs act being passed late in 2021 the updates for 2022 are significant. This webinar will give the payroll professional everything they need to know to stay compliant in 2022, from new legislation to old legislation that employers find challenging to stay compliant with.

Why Should you Attend

This webinar will review record retention requirements along with legislation that if not followed correctly that can cost your company money. This webinar will give you tools and tips to stay compliant with existing and new legislation.

Objectives of the Presentation

To be up to date on current legislation affecting payroll and legislation that has caused the payroll area to struggle and how to overcome those struggles. To make sure you are up to date and are running a payroll that is in compliance for 2022.

Areas Covered

Record Retention

» Payroll Record-Keeping Requirements by agency

» IRS-Internal Revenue Service

» DOL-Department of Labor

» Record retention policies & procedures & the cost of a poor policy

» How to handle and be prepared for audits

» Special Retention Concerns

» Form I-9

» Sarbanes-Oxley

» Mergers & Acquisitions

» Unclaimed Properties

Legislative updates

» W-2 /W-4 Updates

» Tax Reform Changes

» Annual Updates

Common Errors to avoid

» Worker Misclassification

» Overpayment Corrections

» Termination Errors

» Proper state taxation

» Taxing Fringe Benefits

» Obtaining proper substantiation

Who will Benefit

» Payroll

» Accounting and HR professionals

To Register (or) for more details please click on this below link:

<a href=”https://bit.ly/3oSeG77″>https://bit.ly/3oSeG77</a>

Email: support@concordeducations.com

Tel: +1-989-341-8773